Intro to Key levels

1) Describe Key Level.

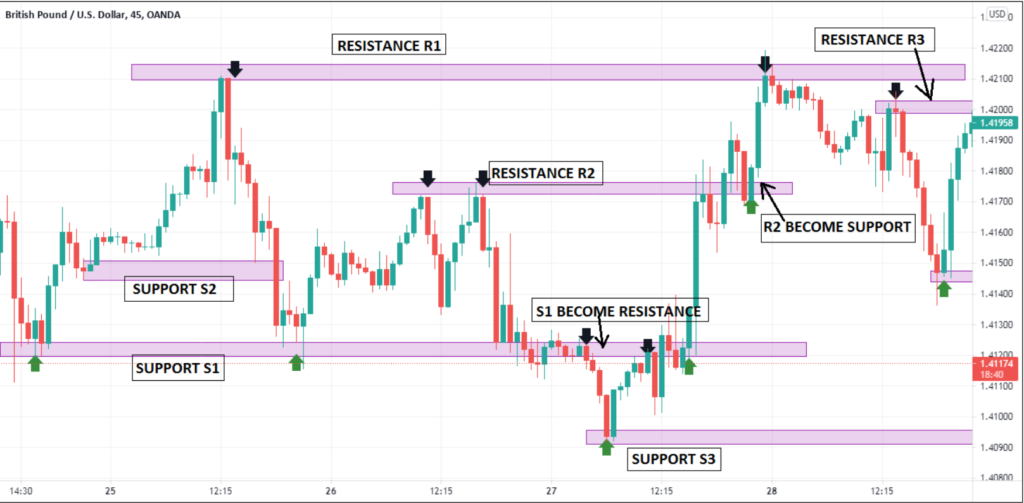

- In trading charts, Support and Resistance acts more significant for technical analysis and gives a strong confirmation for buy and sell signals and sometimes trend reversal too.

- Prices tend to retest support and resistance levels, until broken. Thus, traders can Buy when an asset price is approaching Resistance, and Sell when approaching Support.

- This combination of horizontal multiple supports and resistance together is called as Key Level.

2) Significance of Key Levels.

- Key Levels has higher potential to give buy/sell signals.

- Support may turn into a resistance and vice versa.

- High probability to take multiple entries and exits.

3) Example for Key Levels.