1) What Is the Cboe Volatility Index (VIX)?

- VIX is a real time index of S&P 500 index (SPX) that represents the market participants sentiment basically fear.

- VIX is derived by using the forward near time price expectations or changes from SPX index options with near term expiration dates.

- It generates a 30-day forward projection of volatility.

2) How it works?

- It was created by the Chicago Board Options Exchange(CBOE) and is maintained by Cboe Global Markets.

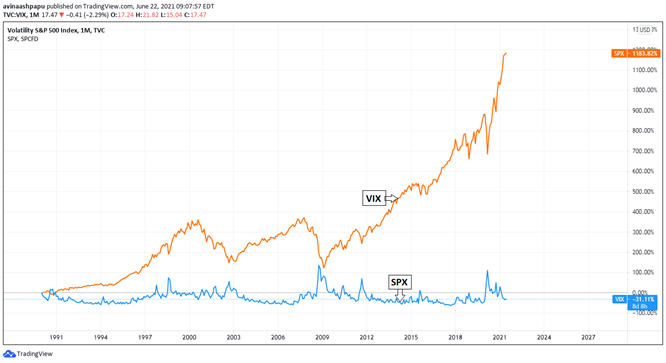

- Volatility value, investors’ fear, and the VIX index values move up when the market is falling. The reverse is true when the market advances—the index values, fear, and volatility decline.

- Thus VIX is considered as the fear gauge tool to analyze the degree of fear among the market participants.

3) Real World Example for VIX with respect to SPX index:

- As VIX tend to move higher it indicates market players are in fear that equity may lose its value and investors hedging their funds on index’s option market.

- In reverse, investors lose their fear when the VIX drops back and equity shows a positive momentum.

- We can see the contradictory movement of VIX and SPX index by the chart given below.